OUR BUSINESS

Quantus manages various investment vehicles that invest exclusively in business-critical real estate. In doing so we focus on single tenant properties and projects.

Either you sell us your business-critical real estate and rent it back: Sale and Rent Back.

Or we build your business-critical real estate to suit and you rent it: Build to Suit.

We support you as a tenant on a partnership basis. Additionally we finance building extensions so that you can concentrate on the future growth of your company.

We finance various different types of business-critical real estate:

- Office

- Logistics

- Industry and production

- Retail

- Health care properties

- Educational buildings

- Special properties (parking, datacentre etc.)

- Student living, serviced apartments and micro living

- etc.

We buy or build your business-critical real estate which allows you to use your equity more efficiently in your core business.

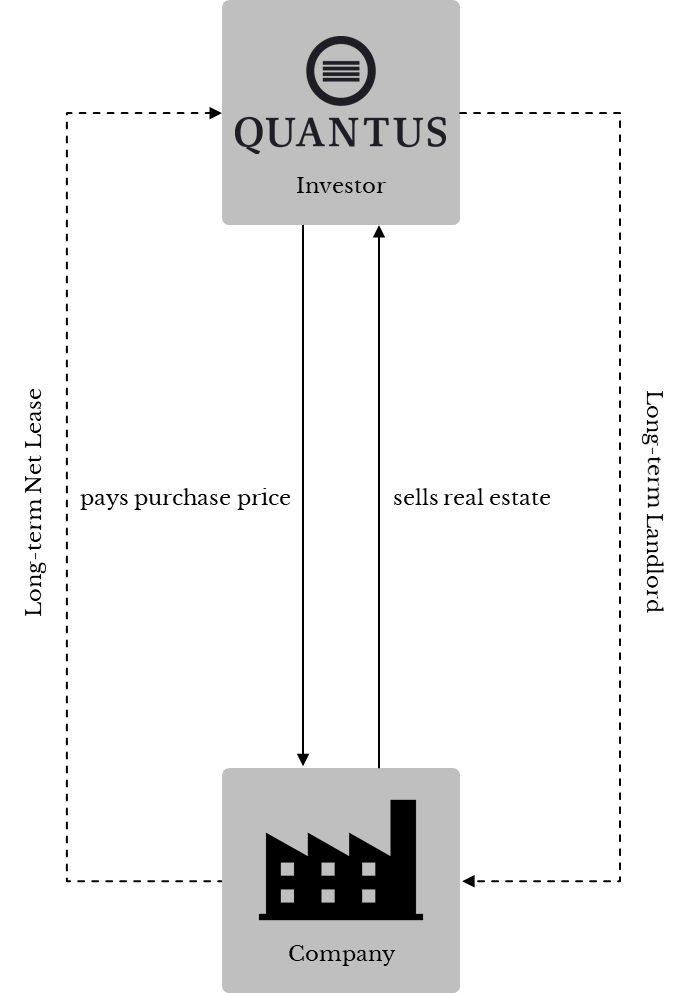

SALE AND RENT BACK

We buy your business-critical real estate and rent it back on a long-term basis.

This allows you to unlock the equity tied up in your real estate assets and redeploy that capital into your core business.

At the same time, you retain full operational control of your business-critical properties for the long term while having the security of a financial partner for future investments in the properties that help drive further growth of your company.

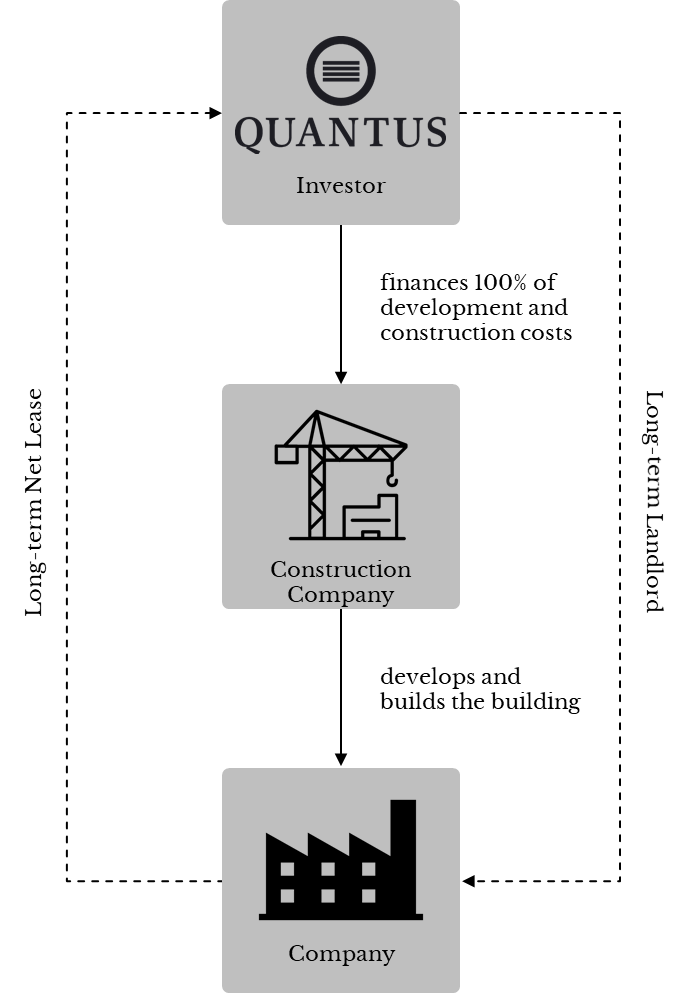

BUILD TO SUIT

We finance 100% of the development and construction costs of your new business-critical real estate.

The business-critical properties are planned and built in such a way that you can optimize the efficiency of your operational business processes.

In addition, you can use your capital more effectively in your core operating business.

REFERENCES SALE AND RENT BACK

Below you will find some references of our sale and rent back-activities. Please do not hesitate to contact us if you would like to know more about us and our projects.

Rotkreuz

Landquart

Estavayer-le-Lac

Alpnach

Bronschofen

Dottikon

Lugano

Lausanne

Widnau

Widnau

Niederwangen

Domdidier

Schmitten

Éclépens

Au

Stabio

Dottikon

Lucens

Koblenz

Küssnacht

Moudon

Henau

Lütisburg

REFERENCES BUILD TO SUIT

Below you will find some references of our build to suit-activities. Please do not hesitate to contact us if you would like to know more about us and our projects.

Affoltern am Albis

Herisau

ABOUT QUANTUS

Quantus Real Estate Finance is a division of Quantus. Quantus is a highly regulated investment manager that invests in real estate and real estate developments through institutional, professional and private investment vehicles.

Quantus focuses on offering tenants and buyers space tailored to their needs and on generating risk adjusted returns for investors.

Quantus was established in 1980 and has been licensed as an account-holding securities firm by the Swiss Financial Market Supervisory Authority FINMA since 2001. The regulation, supervision and function of Swiss securities firms is largely identical to that of Swiss banks. Quantus is a member of the Swiss Bankers Association, Esisuisse, the deposit guarantee scheme for banks and securities firms, and a participant in the Swiss Exchange SIX.

Learn more about Quantus.

CORPORATE GOVERNANCE

BOARD OF DIRECTORS

André M. Schreier

Chairman of the Board of Directors

lic. rer. pol. / Swiss Banking School

Since 2001 André M. Schreier has been co-responsible for the strategic leadership of Quantus. His professional expertise includes leading a bank as CEO, investment banking, commercial banking, recovery management, consulting and the diplomatic service.

Urs Küng

Vice-Chairman of the Board of Directors

lic. oec. HSG

Since 2000 Urs Küng has been co-responsible for the strategic leadership of Quantus. His professional expertise includes Investment Banking, Corporate Finance, Mergers & Acquisitions and Recovery Management.

Danny Hübner

Member of the Board of Directors

lic. oec. publ. / Master of Arts,

Swiss Certified Accountant,

Audit Expert FAOA

Since 2016 Danny Hübner has been co-responsible for the strategic leadership of Quantus. His professional expertise includes. His professional expertise includes extensive experience in the field of auditing, in particular with banks and securities firms.

EXECUTIVE MANAGEMENT

Urs Küng

Chairman of the Board of Directors

lic. oec. HSG

Since 2000 Urs Küng has been co-responsible for the strategic leadership of Quantus. His professional expertise includes Investment Banking, Corporate Finance, Mergers & Acquisitions and Recovery Management.

Katharina Reimann

CIO

Executive MBA HWZ Zurich

Dipl. Civil Engineer, University of Rostock

Katharina Reimann joined the Investment Management team of Quantus in May 2023 and is Head of Transaction Management as CIO. Previously, she was Head of Transactions German-speaking Switzerland at a fund company as well as Member of the Management Team and long-time Project Manager in Acquisitions & Sales at Swiss Prime Site, with a total acquisition volume of around CHF 2 billion. Before that, Katharina Reimann worked in real estate consulting, brokerage and marketing in Switzerland and Germany as well as in project and infrastructure development at an international construction group.

Ines Reichert

Head of Portfolio Management

MBA in Real Estate Management

MSc in Architecture

Ines Reichert has been Head of Portfolio Management at Quantus since September 2023. Prior to this, she was responsible for the portfolio management of a fund management company. In this role, Ines Reichert was responsible for the portfolio management of a listed real estate company investing in healthcare properties, an investment foundation comprising a mixed-use real estate portfolio and a fund investing primarily in inner-city locations. Her focus was on the development of property and portfolio strategies as well as the development and establishment of corresponding monitoring and management tools. Previously, Ines Reichert worked for Wüest Partner and EY in real estate valuation and consulting.

Andrea Wegmann

COO

Specialist in Finance and Accounting with Swiss Federal Certificate

Andrea Wegmann has been responsible for the operational management of Quantus since 2010. Prior to that, she held a leading position with responsibility for the mid and back office at ifund services.

Julia Riesenmann

Legal/Compliance

BSc in Business Law UAS Zurich

Julia Riesenmann has been working for Quantus in Legal/Compliance since 2017. Since 2022, she is responsible for the Legal/Compliance department. Prior to her position at Quantus, she worked in the wealth management department of a bank.

Rolf Biber

CFO

Commercial Education

Since 1994 Rolf Biber has been responsible for the financial management of Quantus. Prior to that, he worked for national and international companies as CFO.

CONTACT

Quantus AG

Kirchenweg 8

8008 Zürich

+41 44 878 99 99

financingrequest@quantus.ch